Wole Olajide

Zenith Bank in the first half of 2020 achieved growth in its topline and bottom line figures. Gross Earnings of the financial giant grew by 4.37% to N346.09 billion from N331.59 billion in the first half of 2019.

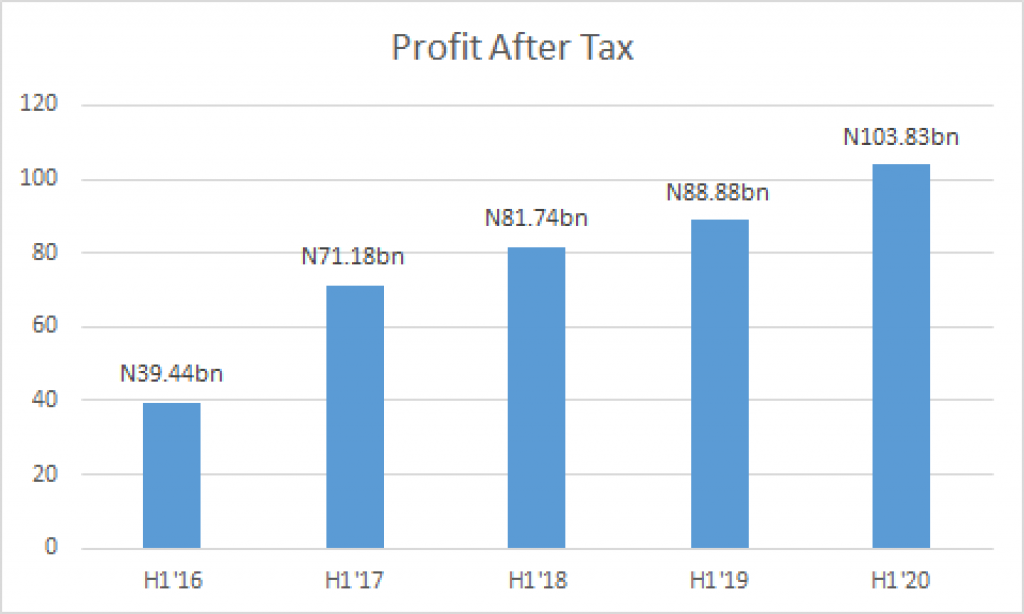

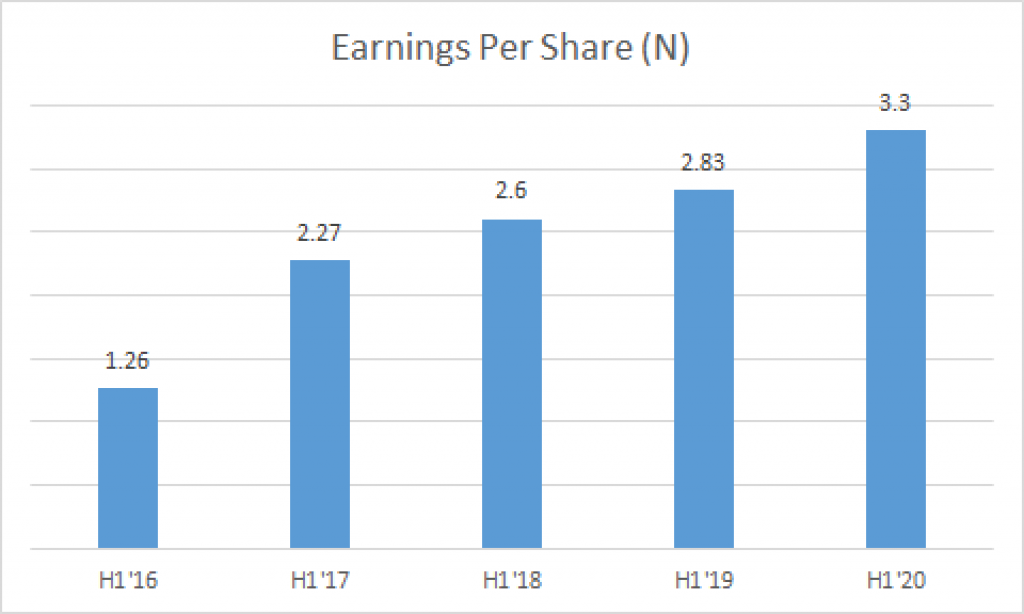

Profit before tax appreciated by 2.19% to N114.12 billion from N111.68 billion reported in H1’19. Profit after tax grew by 16.81% to N103.83 billion from N88.88 billion achieved in the first half of 2019. Earnings per share (EPS) increased to N3.31 from the EPS of N2.83 achieved in the first half of 2019.

Zenith Bank proposed an interim dividend of 30 kobo to its shareholders. Qualification date is on 16th September, 2020. Closure date is on the 17th, of September 2020 while payment date is 22nd of September 2020.

The Board of Directors, pursuant to the powers vested in it by the provisions of section 379 of the Companies and Allied Matters Act (CAMA) of Nigeria, proposed an interim dividend of 30 kobo per share amounting to N9.4 billion from the retained earnings account as at 30 June, 2020.

Impact of COVID-19 on business operations

Owing to the novel Covid-19 pandemic, reduced demand in the oil market, and restricted international trade activities, the outlook of the nation’s Gross Domestic Product (GDP) had been expectedly negative. Nigeria’s Q2 GDP of -6.10% reveals that there are indeed challenges that cannot be ignored. Beyond the effect of the pandemic, the oil price wars driven by Saudi Arabia & Russia, have increased the level of uncertainty in the oil market.

In the 2020 budget, Nigeria had significantly cut the benchmark price to $25 per barrel without changing so much in terms of spending, making the nation susceptible to borrowing even more.

The impact of the pandemic has not yet been reflected in Q2, 2020 results of the bank. This is because the economic impact of the pandemic actually commenced in April. The economic performance for Q2 and subsequent quarters in the year might not be too fantastic and there are visible reasons for this. Top on the list is that the non-oil economy will likely not offer the solace the economy needs. With the typical perils of increasing inflation as well as the continued closure of the border, growth may remain farfetched for the sector. Of course, restrictions in international trade and travel are set to worsen the said outlook. Given the forgoing, there is no gainsaying the fact that bigger challenges will ensue from the second into third quarter of the year.

The economy is seen gaining some traction towards year end. In particular, increased credit provision to specific sectors of the economy through CBN interventions and other palliative measures by government to cushion the effects of the Covid-19 pandemic should lend support to consumer demand and the non-oil segment of the economy. However, the slow progress on structural reforms and oil price volatility pose key risks to the outlook.

The Bank regularly assesses it’s resilience to changes in micro and macro environments with specific actions to address any observed or anticipated challenges.

The Bank strongly believe it is well positioned to deal with liquidity risk and funding challenges that may arise from any adverse situations and our capital and earnings capacity (profitability) can withstand the shocks that may arise.

Zenith Bank Plc will continue to support its customers as much as possible in terms of foreign exchange funding challenges; credit performance obligations (restructuring repayments to match cash-flows, where necessary);

Some of the key risk management strategies in the period include the following:

- The bank’s business continuity activities are constantly being reviewed and strengthened to reflect the current and potential impacts of Covid-19 pandemic

- The bank has also developed a strategic crisis-action plan to guide the organization’s response across all Covid-19 scenarios – short, medium and long term.

Trend in half year performance for 5 years

For the past 5 years, Zenith bank consistently recorded growth in its topline and bottom line figures in its half year results. Gross Earnings, Profit after tax and Earnings per share significantly appreciated year on year.

In 5 years, the Assets of the bank grew from N669 billion in 2016 to N1.7 trillion in 2020.

The Book value per share of Zenith Bank is N31.5. Relative to the current share price of N17.25, it implies that Zenith Bank is underpriced. At that, the share price of the Zenith Bank has growth potential.

Zenith Bank Plc was established in May 1990, and commenced operations in July of the same year as a commercial bank. The Bank became a public limited company on June 17, 2004 and was listed on the Nigerian Stock Exchange (NSE) on October 21, 2004 following a highly successful Initial Public Offering (IPO). Zenith Bank Plc currently has a shareholder base of about one million. In 2013, the Bank listed $850 million worth of its shares at $6.80 each on the London Stock Exchange (LSE).

Headquartered in Lagos, Nigeria, Zenith Bank Plc has over 500 branches and business offices in prime commercial centres in all states of the federation and the Federal Capital Territory (FCT). In March 2007, Zenith Bank was licensed by the Financial Services Authority (FSA) of the United Kingdom to establish Zenith Bank (UK) Limited as the United Kingdom subsidiary of Zenith Bank Plc.

Zenith Bank also has subsidiaries in: Ghana, Zenith Bank (Ghana) Limited; Sierra Leone, Zenith Bank (Sierra Leone) Limited; Gambia, Zenith Bank (Gambia) Limited. The bank also has representative office in The People’s Republic of China. The Bank plans to take the Zenith brand to other African countries as well as the European and Asian markets.

Zenith Bank Plc blazed the trail in digital banking in Nigeria; scoring several firsts in the deployment of Information and Communication Technology (ICT) infrastructure to create innovative products that meet the needs of its teeming customers.

The bank is verifiably a leader in the deployment of various channels of banking technology, and the Zenith brand has become synonymous with the deployment of state-of-the-art technologies in banking. Driven by a culture of excellence and strict adherence to global best practices, the Bank has combined vision, skillful banking expertise, and cutting-edge technology to create products and services that anticipate and meet customers’ expectations; enable businesses to thrive and grow wealth for customers.