The market last week was bombarded with notifications of closed period ahead of the release of Q4 financial results for year 2020. At that, investors have been taking positions in stocks that will give them good dividend yield; and this can be linked to the current bullish trend in the market.

Performance of quoted companies in Q2 and Q3 of 2020 was mixed as a few of them reflected the impact of lockdown triggered by covid-19 pandemic. A large number of these companies most especially banks were able to weather the storm. We could say these companies did not do badly, despite the obvious challenges that plagued business operations caused by Covid-19 pandemic. Year 2020 was really tough on businesses as Covid-19 pandemic brought compulsory lockdown. Not quite long after the lockdown, EndSARS protest also came with another brick wall on businesses. If companies could still release good results, despite obvious challenges, then we could say they have not done badly.

Earnings season for Q4 result is around the corner as we have seen the market been flooded with notifications of closed period.

We deem it necessary to do earnings forecast for banking stocks ahead the release of their Q4 earnings for 2020.

Our projections of Q4 earnings for banks is based on their PEG ratios. PEG ratio (price/earnings to growth ratio) is a valuation metric for determining the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company’s expected growth. In other words, it is not enough for anyone to invest on just the strength of a company’s previous or latest earnings but these in addition to the expected earnings.

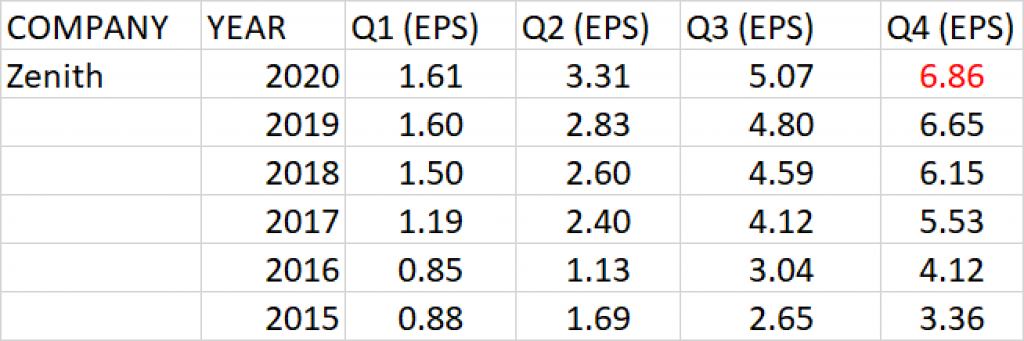

ZENITH BANK

Zenith Bank has performed over the years with consistent growth in turnover, profit after tax and earnings per share especially with good dividend pay-out record. The Bank has been consistent with both interim and final dividend.

Earnings history of Zenith Bank for Q1, Q2 and Q3 in the past 5 years show that the bank has been consistent in improving on its earnings per share year on year.

Consistent growth is observed in the bank’s results within a financial year, Q1 to Q3. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

Q4 earnings per share (EPS) of the bank over the last 5 years has a geometric growth rate of 18.61%.

Relative to the current share price of N26.3 and Q4’19 earnings per share of N6.65, P.E ratio of the bank is evaluated as 3.95x.

PEG ratio against the expected Q4 earnings is 0.21, which makes the share price of Zenith Bank underpriced at current price.

Earnings per share of about N6.86 is projected for Zenith Bank in its Full Year 2020 audited report.

We expect Zenith Bank to pay final dividend of N2.50 in addition to the interim dividend of 30 kobo already paid. This would amount to total dividend of N2.80, same as the previous year.

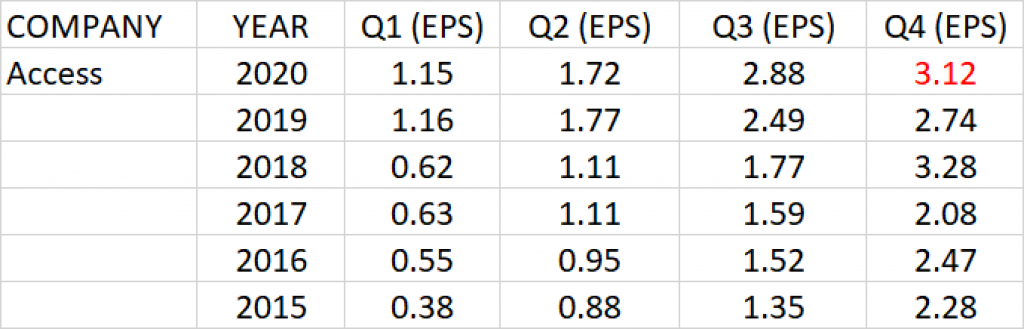

ACCESS BANK

Earnings history of Access Bank Plc for Q1, Q2, and Q3 for the past 5 years show that the bank has been consistent in improving on its earnings per share year on year.

Consistent growth is observed in the bank’s results within a financial year, Q1, Q2, Q3 and Q4. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

Q4 earnings per share (EPS) of the bank over the last 5 years has a geometric average growth rate of 4.70%.

Relative to the share price of N9.7 and Q4’19 earnings per share of N2.74, P.E ratio of the bank is estimated at 3.54x.

PEG ratio against the expected Q4 earnings is 0.75 and it implies that the share price of Access Bank at current price is underpriced.

Earnings per share of N3.49 is projected for Access Bank Plc in Full Year 2020 audited report.

Access Bank is likely to pay a final dividend of 40 kobo in addition to 25 kobo interim dividend, making a total dividend of 65 kobo.

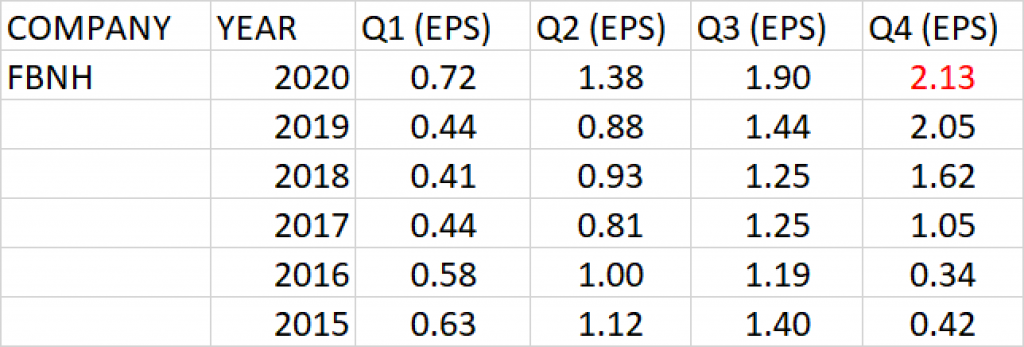

FIRST BANK OF NIGERIA HOLDINGS (FBNH)

Consistent growth is observed in the bank’s results within a financial year, Q1 to Q3. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

Q4 earnings per share (EPS) of the bank over the last 5 years has a geometric average growth rate of 48.64%.

Relative to the current share price of N7.6 and Q4’19 earnings per share of N2.05, P.E ratio of the big elephant is calculated as 3.71x.

PEG ratio against the expected Q4 earnings is 0.08, which makes the share price of First Bank of Nigeria Holdings Plc underpriced at current price.

Earnings per share of N2.13 is projected for First Bank of Nigeria Holdings (FBNH) in Full Year 2020 financial report.

The share price of the big elephant has performed over the years and the stock is very resilient. The effort the management of the bank have put into cleaning their book of non-performing loan is very credible.

FBNH is likely to pay a final dividend of 38 kobo same as the previous year.

GUARANTY TRUST BANK

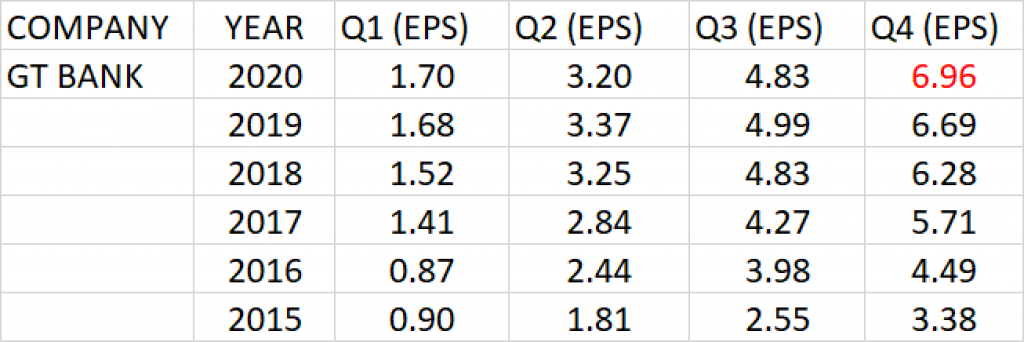

Guaranty Trust bank in the last five years has shown consistent growth in its profit after tax and earnings per share. The bank has been consistent with dividend payout of both interim and final.

Except for Q2’20 where EPS dropped to N3.20, the earnings history of the Guaranty Trust Bank for Q1, Q2 and Q3 over the years show that the Guaranty Trust Bank has been consistent growing its earnings per share.

Q4 earnings per share (EPS) of the bank since 2015 has a geometric average growth rate of 18.61%.

Relative to the current share price of N33.05 and Q4’19 earnings per share of N6.69, P.E ratio of the bank is calculated as 4.94x.

PEG ratio against the expected Q4 earnings is 0.27, which makes the share price of Guaranty Trust Bank underpriced at current price.

Earnings per share of N6.96 is projected for Guaranty Trust Bank in Full Year 2020 audited report.

We expect Guaranty Trust Bank to pay final dividend of N2.50 in addition to the interim dividend of 30 kobo already paid. This will amount to total dividend of N2.80, same as the previous year.

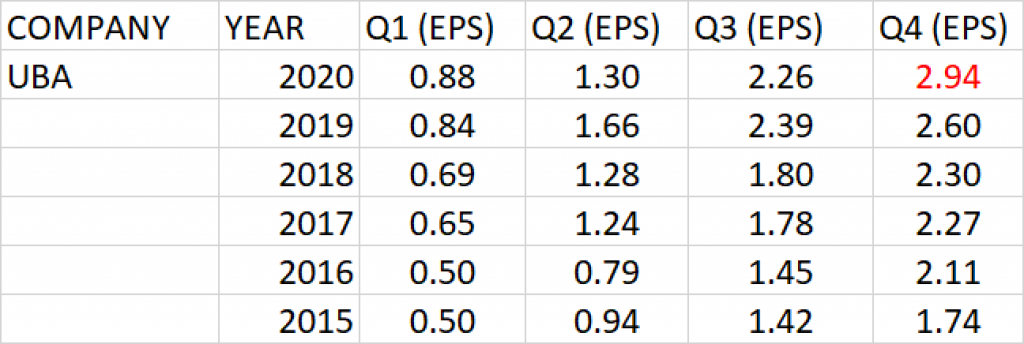

UNITED BANK FOR AFRICA

Despite the drop in Q2’20 Earnings per share of UBA, the bank was still able to pay 17 kobo interim dividend to its shareholders.

Consistent growth is observed in the bank’s results within a financial year, Q1 to Q3.

Q4 earnings per share (EPS) of the bank over the last 5 years has a geometric average growth rate of 10.56%.

Relative to the current share price of N9.25 and Q4’19 earnings per share of N2.60, P.E ratio of UBA is evaluated as 3.56x.

PEG ratio against the expected Q4 earnings is 0.34, which makes the share price of UBA underpriced at current price.

Earnings per share of N2.94 is projected for UBA in its Full Year 2020 audited report.

UBA is likely to pay a final dividend of 80 kobo in addition to the 17 kobo interim dividend, which would amount to 97 kobo dividend payout for 2020.