United Capital is the first Investment Bank to be listed on the Nigerian Stock Exchange. It maintains a holding company structure with subsidiaries in the Consumer Lending, Trusteeship, Securities Trading and Asset Management business.

In the third quarter of 2020, the Group showed significant growth in key indicators despite the challenging global economic climate. Total Revenue in Q3 2020 soared to N7.07bn from N5.32bn in Q3 2019. An increase of 26% was recorded in profit before tax (PBT). Profit after tax (PAT) also grew by 26% year-on-year. Total Assets grew by 41%, being well financed by a 46% increase in Liabilities and a slight increase in Shareholders Fund by 2.5%.

While commenting on the group’s performance the Group CEO, Peter Ashade, stated thus:

“Our operating environment remains tough amid the lingering COVID-19 situation and negative macroeconomic impacts as seen in the continued depreciation of the exchange rate, consistent uptick in headline inflation rate among other macroeconomic indicators. As stated during the release of our H1-2020 results, our business has not been immune to these challenges.

Notwithstanding, the Group has remained nimble. We continued to implement our business growth and continuity plans premised on a solid risk assessment framework to ensure we remained focused on providing best-in-class solutions to all client segments. These contributed to the impressive growth across our businesses leading to 33% growth in revenue and 26% increase in both PBT and PAT during the nine-month period.

“In Q2, the Group successfully issued N10 billion Series 1 Bond under the N30 billion Medium Term Debt Program – the first to be issued by an investment banking firm in Nigeria – which was oversubscribed by about 24%. We have begun yielding the fruit of that strategic decision.”

“Going into the last quarter of the year, we are encouraged by the increasing market confidence in our brand even in the wake of the most globally devastating pandemic of the last century. We know the operating environment is turbulent, but we are committed to deliver superior returns to our shareholders, as we drive growth and profitability across all our businesses.”

“In line with our initial strategy for the 2020 business year, we shall continue to push further our market diversification and cost-optimization initiatives as well as implement phased automation of our business processes whilst upholding our commitment to ensuring a significant improvement in our value delivery to all our stakeholders.”

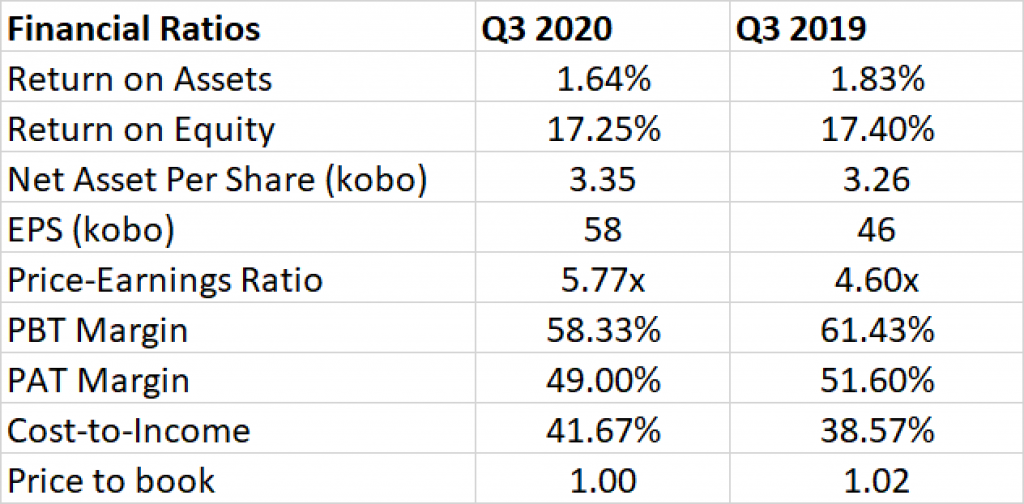

Year-on-Year Analysis of the third quarter report of the Group reveals the following:

- Gross Earnings: N7.07 billion in Q3 2020, compared to N5.32 billion in Q3 2019 (33% YoY Increase)

- Net Operating Income: N6.76 billion in Q3 2020, compared to N4.29 billion in Q3 2019 (58% YoY Increase)

- Operating expenses: N2.95 billion in Q3 2020, compared to N2.05 billion in Q3 2019 (44% YoY Increase).

- Profit Before Tax: N4.12 billion in Q3 2020, compared to N3.27 billion in Q3 2019 (26% YoY Increase)

- Profit After Tax: N3.46 billion in Q3 2020, compared to N2.75 billion in Q3 2019 (26% YoY Increase)

- Total Assets: N211.53 billion, compared to N150.46 billion as at FY 2019 (41% YTD growth)

- Total Liabilities: N191.45 billion, compared to N130.88billion as at FY 2019 (46% YTD growth)

- Shareholders Fund: N20.08 billion, increasing by 2.5% YTD compared to FY 2019’s value at N19.59 billion.

United Capital Plc is a leading Pan-African financial and investment services group, with a mission to provide bespoke and innovative value-added services to its client. The group aims to transform the African continent by providing innovative and creative investment banking solutions to governments, companies, and individuals.

The company which was listed on the Nigerian Stock Exchange on the 17th of January 2013 is setting the pace to becoming the financial and investment role model across Africa, by deploying innovation, technology, and specialist skills to exceed client expectations, while creating more value for all stakeholders.