- Contracted Q2 earnings inevitable

Manufacturing has generally been described and accepted as an engine of growth and development of any country. In modern economies, industrialization is widely conceived as critical tool for accelerating economic growth and development. Covid-19 pandemic took the world by surprise and has engulfed nearly the entire world, claiming lives and damaging businesses and at large hitting hard on economies of world.

The Coronavirus outbreak resulted in mass production shutdowns and supply chain disruptions due to port closures, causing global ripple effects across all economic sectors in a rare twin supply-demand shock.

Nigeria’s manufacturing sector is not spared from the root-to-branch shutdown of global supply chains. Port restrictions in China weighed on 14% of Nigeria’s manufacturing sector that rely on raw material import from China.

Raw materials, production process, disrupted distribution channels, growing inventory and difficulty in debt collection are few among major challenges the manufacturing companies had to battle with the emergence of the corona virus pandemic in quarter two of 2020.

Interstate movement restriction limited the availability of raw materials for production which consequently increase cost of sourcing raw materials. Many manufacturing firms suffer this having their production capacities reduced and of course this consequently would result to a stunted turnover growth.

There was also a major disruption in production process. When there was total lockdown, most of the machines even when they are robots still need human interface. That brought down the productivity of most manufacturing firms. They could not utilize the capacity fully as they were prior covid-19 saga.

Disruption of distribution channels also became a major challenge. Manufacturers were not able to distribute their products so well during the lockdown. Sales dropped as they were unable to make their products available even when people want to buy. Shops were closed, especially big malls where their products are sold.

There are obvious fall in household consumption due to partial (or full) restrictions on movement, thus causing consumers to spend primarily on essential goods and services and reduced the consumption of nonessential commodities in general of which most of this products are either directly produced or assemble by players in the manufacturing sector.

To a large extent, manufacturing companies in Nigeria have over the years scaled through several hurdles and obvious challenges to remain in business, top of these is financing while others include infrastructure, low purchasing power and government policies.

According to a report, the Manufacturing CEOs Confidence Index for the first quarter of the year already fell below the 50 points benchmark indicating that Nigeria’s manufacturing sector requires a lifeline to recover fully from the impact of the COVID-19 outbreak.

Q2’20 Outlook

The worst hit sector of the economy by the covid-19 pandemic is the manufacturing sector of course, because there is a possibility of working from home in other sectors. Even in an automated manufacturing process, the process still requires the interface of a human being to function well talk less of those operating in a labor intensive process.

Second quarter earnings of manufacturing companies for 2020 will slow down compared to previous year’s performance due to lockdown that affected operations in the manufacturing sector.

Speaking on the impact of covid 19 on manufacturing sector, Bright Otoghile, Managing Director of Gruene Capital Limited pointed out that the manufacturing firms in Nigeria have not been having a good time. Though in the medical subsector, who are into manufacturing of health related items, there might be positive outcome in terms of revenue. But how sustainable will this revenue be, knowing fully well there is increasing cost due to covid-19.

According to Mr Otoghile, the expected figures for manufacturing sector will not be too rosy.

“I expect on the average across board to see between 5 to 10% marginal drop in some of the result we will be seeing from manufacturing sector because the cost of doing business have really impacted whatever they are doing.

In the last 2 months, economic activities has been on the lowest ebb. Even with the gradual ease of lockdown, there is threat on the manufacturing firms. By and large, manufacturing firms have not been having good time as a result of increasing cost of manufacturing. With the restriction on movement, both international and local, it’s a challenge for manufacturers.

You need a high level of trust to have your raw materials imported, since there is no privilege to travel to inspect your order. Operators in the manufacturing sector that are actually leveraging on physical contact to carry out their operations are faced with movement restriction. We were thinking that by June 21, the airline will begin to fly again, there has been a reversal on that policy.

With the rising threat of covid-19, manufacturing companies without mincing words are going to face a very tough time now and ahead. Until all these are resolved, manufacturing sector will continue to breathe with one nose.

We need to play our part very well by looking at those companies that are able to weather the storm. Those that the present state of demand and supply is favoring. Because whether you like it or not, pandemic or no pandemic, survival of man is paramount; that is why the economy is still pushing both locally and internationally.”

A glimpse into the half year earnings history of manufacturing companies revealed that most manufacturing companies in Nigeria survive majorly on credit facilities. Unfortunately, high cost of financing had largely impacted negatively on profitability.

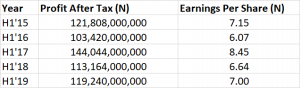

DANGOTE CEMENT

Dangote Cement’s major source of business is from Building & Construction and it is largely driven by government policies and infrastructure spend. In recent times, the sector has witness the influx of international building and construction firms seeking partnership with the FGN to bridge the infrastructure gap in the country. 2019 Q3 GDP shows 11% growth in the Cement sub-sector. YoY growth is 6.87%.

The cement producer has over the year proven to be leader among its competitors both in stock price performance and market capitalization.

In the second quarter of 2015, Dangote Cement achieved a profit after tax of N121.81 billion and the earnings per share of N7.15.

In 2016, Q2 profit after tax dropped to N103.42 billion and earnings per share also dropped to N6.07.

In 2017, Q2 profit after tax grew to N144 billion and earnings per share rose to N8.45.

In 2018, Q2 profit after tax declined to N113.16 billion and earnings per share likewise dropped to N6.64.

In 2019, Q2 profit after tax rose to N119.24 billion and earnings per share rose to N7.00.

If you look at the pattern of growth in earnings, one should not think it twice to conclude the firm’s earnings this review period would of necessity drop by certain percent, especially if one factor in the impact of covid-19 on the business. Cashflow in Q2 is expected to contract due to

- Lockdown restrictions which might have necessitated factory shutdown for some period.

- Slowing demand due to lockdown also.

- Dwindling government revenue and Covid-19 lockdown/social distancing will have negative impacts on ongoing and potential infrastructure projects.

The table below shows Dangote Sugar’s Q2 5years history

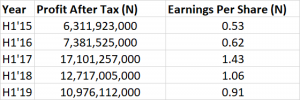

DANGOTE SUGAR

Dangote Sugar is among the strong brands offered by Dangote group. The Sugar producer recorded a generally unimpressive financial performance in the first half of 2019.

In its 5years earnings history, Dangote Sugar reported a profit after tax of N6.31 billion and earnings per share of N0.53 in the second quarter of 2015. In 2016, Q2 profit after tax grew to N7.38 billion and earnings per share likewise rose to N0.62. In 2017, Q2 profit after tax grew further to N17.1 billion and earnings per share rose to N1.43. However in 2018, Q2 profit after tax dropped to N12.72 billion and earnings per share declined to N1.06. Profit after tax declined further in the second quarter of 2019 to N10.98 billion and earnings per share also dropped to N0.91.

Like every other consumer good products, sugar as a product is beset with many challenge ranging from supply chain disruptions, low patronage and many more. It is therefore worthy to note that second quarter earnings for 2020 of Dangote Sugar may fall short of the previous year’s performance due to the impact of coronavirus on businesses in Nigeria.

The table below shows Dangote Sugar’s Q2 5 years history

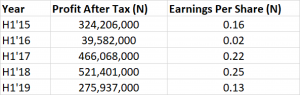

FIDSON

Fidson Healthcare Plc is a leading pharmaceutical manufacturing company in Nigeria. Just like Bright Otoghile has posited, the medical subsector, who are into manufacturing of health related items should see positive outcome in terms of revenue because they are the ones taking centre stage in the Covid-19 fight. You may want to ask how this is positive for the healthcare manufacturers despite the intense pressure and challenges they face in providing solution to the pandemic that has turn the whole globe a dreaded zone. The present challenge should of necessity track a major upturn in our local research by government funding our local producers to look inward for solutions. One of the major lapses exposed by this epidemic is our dependence on Indian and china for imported drugs.

In the second quarter of 2015, Fidson reported a profit after tax of N324.2 million and earnings per share of 16 kobo. In 2016, Q2 profit after tax declined to N39.58 million and earnings per share dropped to 2 kobo. Profit after tax rose to N466 million in Q2 2017 and earnings per share likewise appreciated to 22 kobo. In 2018, Q2 profit after tax rose to N521.4 million and earnings per share grew to 25 kobo. In 2019, Q2 profit after tax declined to N275.94 million and earnings per share also dropped to 13 kobo.

On the interim, Q2 earnings for 2020 of Fidson Healthcare may fall short of the previous year’s performance but a major breakthrough in vaccine discovery would bring a big bang for the company.

The table below shows Fidson Healthcare Plc’s Q2 5 years history

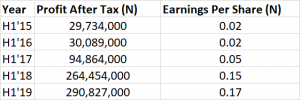

MAY & BAKER

Also in the Healthcare business, May and baker may also see a moderated earnings in the period under review. Half year earnings history of May & Baker for five years however shows consistent growth in the firm’s profit after tax and earnings per share.

In the second quarter of 2015, May & Baker reported a profit after tax of N29.73 million and earnings per share of 2 kobo. In 2016, Q2 earnings per share grew to N30.09 million and earnings per share remained at 2 kobo. In 2017, Q2 profit after tax appreciated to N94.86 million and earnings per share grew to 5 kobo. In 2018, Q2 profit after tax grew to N264.45 million and earnings per share rose to 15 kobo. In 2019, Q2 profit after tax rose to N290.83 million and earnings per share appreciated to 17 kobo.

The table below shows May & Baker Plc’s Q2 5 years history

NESTLE

Nestle’s profitability in the distressed Q2 season is non-negotiable. The company’s composite products fall under the essential products and necessary consumables even in the time of war but the disrupted supply and distribution channels are major force against the brand and other fast moving consumer goods as the world races against the impact of covid-19 pandemic.

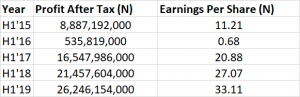

Apart from 2016, the half year performance of the multinational has seen consistent growth by wide margin. Nestle Nigeria in the second quarter of 2015 achieved the profit after tax of N8.89 billion and earnings per share of N11.21. In 2016, Q2 profit after tax declined to N535.82 million and earnings per share dropped to 68 kobo. In 2017, Q2 profit after tax grew to N16.55 billion and earnings per share rose to N20.88. In 2018, Q2 profit after tax grew further to N21.46 billion and earnings per share rose to N27.07. In 2019, Q2 profit after tax appreciated to N26.25 billion and earnings per share likewise rose to N33.11.

The table below shows Nestle’s Q2 5 years history

CADBURY

Falling in the same category of FMCG as Nestle, you expect the same force against Nestle should hold for Cadbury but I must confess that the impact will be detrimental for one than the other but I will save that comparison for another day.

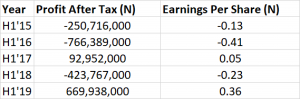

Cadbury in the second quarter of 2015 declared a loss of N250.72 million and earnings per share was -13 kobo. In 2016 another loss of N766.39 million was reported with earnings per share of -41 kobo. In 2017, Q2 profit after tax grew to N92.95 million and earnings per share of 5 kobo was achieved. In the second quarter of 2018, Cadbury declared a loss of N423.77 million and earnings per share dropped to -23 kobo. In 2019, Q2 profit after tax grew to N669.94 million and earnings per share appreciated to 36 kobo.

Second quarter earnings of Cadbury for 2020 may fall short of the previous year’s performance due to the impact of coronavirus on businesses in Nigeria.

The table below shows Cadbury’s Q2 5 years history

FLOUR MILLS OF NIGERIA

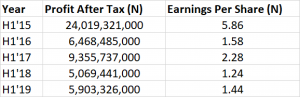

In the second quarter of 2015, Flour Mill of Nigeria reported a profit after tax of N24 billion and earnings per share of N5.86. In 2016, Q2 profit after tax dropped to N6.47 billion and earnings per share declined to N1.58. In 2017, Q2 profit after tax rose to N9.36 billion and earnings per share appreciated to N2.28. In 2018, Q2 profit after tax decline to N5.07 billion and earnings per share dropped to N1.24. In 2019, Q2 profit after tax grew to N5.9 billion and earnings per share appreciated to N1.44.

Second quarter earnings of Flour Mills for 2020 may fall short of the previous year’s performance due to the impact of coronavirus on businesses in Nigeria.

The table below shows Q2 history of the firm for 5 years

PZ NIGERIA

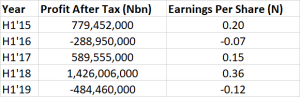

In the second quarter of 2015, PZ reported a profit after tax of 779.45 million and earnings per share of 20 kobo. In 2016, the firm declared a loss of N288.95 million and earnings per share was -7 kobo. In 2017, Q2 profit after tax grew to N589.56 million and earnings per share appreciated to 15 kobo. In 2018, Q2 profit after tax appreciated to N1.43 billion and earnings per share grew to 36 kobo. In the second quarter of 2019, PZ declared a loss of N484.46 million and earnings per share dropped to -12 kobo.

The table below shows Q2 history of the firm for 5 years

NIGERIAN BREWERIES

Social gathering ban is a major policy that will contract significantly the cashflow of this brewery giant. The growing index cases of corona virus saw the government ban all social gatherings in the country and this means all ‘owanbes’, beer parlors and recreational centers remain shut till further notice. We all know these are the venue where many brands of the products from this company sells. Thanks to the ardent lovers of these brands, many still find ways to patronize these brands and we are sure the brand is not dying but definitely not without a declined sales like every other businesses have experienced in this trying period.

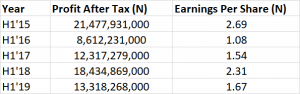

Nigerian Breweries in the second quarter of 2015 reported a profit after tax of N21.48 billion and earnings per share of N2.69. In 2016, Q2 profit after tax declined to N8.6 billion and earnings per share dropped to N1.08. In 2017, Q2 profit after tax grew to N12.3 billion and earnings per share rose to N1.54. In 2018, Q2 profit after tax appreciated to N18.43 billion and earnings per share grew to N2.31. In 2019, Q2 profit after tax declined to N13.3 billion and earnings per share declined to N1.67.

The table below shows Q2 history of the firm for 5 years

UNILEVER

In the second quarter of 2015, Unilever reported the profit after tax of N85.57 million and earnings per share of 1 kobo. In 2016, Q2 profit after tax dropped to N52 million while earnings per share remained at 1 kobo. In 2017, Q2 profit after tax grew to N2.07 billion and earnings per share grew to 36 kobo. In 2018, Q2 profit after tax grew further to N2.86 billion and earnings per share appreciated to 50 kobo. In 2019, Q2 profit after tax declined to N1.99 billion and earnings per share likewise dropped to 35 kobo.

The table below shows Q2 history of the firm for 5 years

WAPCO (LAFARGE)

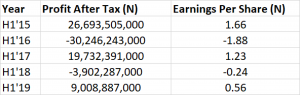

WAPCO in the second quarter of 2015, WAPCO achieved the profit after tax of N26.69 billion and earnings per share of N1.66. In the second quarter of 2016, the firm declared a loss of N30.25 billion while earnings per share was –N1.88. In 2017, Q2 profit after tax grew to N19.73 billion and earnings per share likewise appreciated to N1.23. In the second 2018, WAPCO declared a loss of N3.9 billion while earnings per share was -24 kobo. In 2019, Q2 profit after tax grew to N9 billion and earnings per share likewise appreciated to 56 kobo.

The table below shows Q2 history of the firm for 5 years

HONEYWELL FLOUR MILLS

The accounting year of Honeywell Flour Mills does not end in December, it rather ends in March. The full year audited report of the firm for the year ended, 31 March 2020 is yet to be released. The impact of covid-19 may not reflect on the full year report as lockdown effective almost at the end of March. First Quarter result of the firm which will be due by the end of June will reflect the impact of covid-19 on the business operations of the firm. At that, we shall consider the Q1 earnings history of Honeywell Flourmills for five years as basis for our projection for what to expect for the firm’s expected Q1 result.

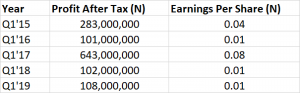

In the first quarter of 2015, Honeywell Flour Mills reported profit after tax of N283 million and earnings per share of 4 kobo. In 2016, Q1 profit after tax declined to N101 million and earnings per share dropped to 1 kobo. In 2017, Q1 profit after tax grew to N643 million and earnings per share rose to 8 kobo. In 2018, Q1 profit after tax declined to N102 million and earnings per share dropped to 1 kobo. In 2019, Q1 profit after tax appreciated to N108 million while earnings per share remained at 1 kobo.

Based on the current economic reality caused by covid-19 and the fact that most of the second quarter period was under lockdown, Q1 figures of Honeywell Flour Mills may slow down when compared to the previous year’s performance.

The table below shows Q1 history of the firm for 5 years

By and large, the threat of the second wave of covid-19 is there. Once the threat is factored into every decision making process, then we will come to understand that cost issue will continue to rise because nobody knows what will happen with the covid-19. We are all speculating. Until there is a concrete evidence, concrete development, established fact that vaccine has been developed for covid-19, we will continue to speculate. Countries will continue to manage the outcome of the pandemic as the economy tend to open. With the new threat of rising cases of covid-19, the opening of the economy becomes a threat itself. It like a vicious cycle of covid-19 impact both locally and internationally. If we are able to break that cycle by the development of vaccine, what we are seeing will not end.