Read also: market analysts explain the new pricing methodology

Trading activities on the floor of the Nigerian Stocks Exchange closed positive on Tuesday, extending its winning streak to three days consecutive record.

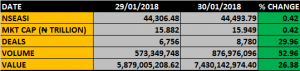

The All-Share Index grew 0.42 percent amidst sustained optimisms, with strong indications that the market might climb further to book its 4th straight gaining day on Wednesday.

The ASI, though touched an intraday low at 43,987.22, finally close at 44,493.79 points, as against the 44,306.48 points it closed on Monday, adding 187.31 points to bring the year-to-date growth to 16.34 percent.

The market capitalisation also surged by N67 billion, rounding up at N15.950 trillion as at the end of the Tuesday’s trading session.

In volume and deals, the transactions recorded was higher than the previous, as the number of shares traded closed higher with 876.98million against 573.35million shares, which exchanged hands in 8,780 against 6, 756 deals, valued at N7.43billion against the N5.88billion of the comparative periods.

Market Breadth

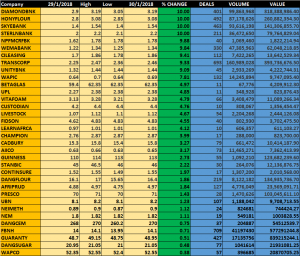

Market Breadth ended positive with 34 gaining stocks paired against 24 losing equities out of 106 traded stocks.

Low priced equities dominated the percentage gainers’ chart with Diamond Bank, Honeywell flour, Skye and Sterling banks leading the league by 10% price appreciation each.

Others in the league are; NPFM, gained 9.88%, WEMA, gained 9.84%, followed by C&I,which gained 9.41% and Transcorp among others, gained 9.55%.

Percentage gainers

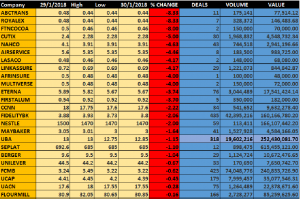

On the other hand, depressed by the new pricing rule, ABC Transport and Royal Exchange both lost 8.33% to emerge the worst traded stocks of the day, after they both plunged further below the former per value pricing of 50 kobo. FTNcocoa alsoso plunged 8% to join the league of stocks affected by the new pricing rule.

Others on the list are Cutix, Nahco, Airservice, while African insurance and Multiverse also resumed trade below former 50kobo value after they both lost 4% value in price

Percentage losers

Transcorp traded the highest volume at 160.99 million units of shares worth N393.74 million in 693 deals, gaining 21kobo to close at N2.46.

FBNH attracted highest numbers of deals exchanging hands 709 times, while Nigerian Breweries emerged the stock with highest turnover value of N1.732billion.