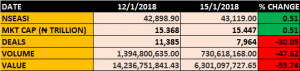

The Nigeria Equities market opened the week on a positive note bouncing back to green as the All Share Index grew 0.51 percent, adding 220.1 point, to close at 43,119.00 away from 42,898.90 it last closed. The market capilisation with about N8billion increase climbed to close at N15.447 trillion, against N15.368, which is also 0.51 percent corresponding DnD growth.

The green printed market was largely buoyed by gains in DANGOTE CEMENT and few bargain hunt in some Banking stocks, which saw the bourse stay afloat despite the profit taking we saw in selective Consumer and Oil and Gas stocks.

We however still envisage a slight pullback based on a potential and further profit taking, which may drive the market to a negative close. But of course this should only hint of possible low or late entry opportunities, especially for the much anticipated full year result.

Read Also:

NSEASI tests 7-year high, as the market closes 2.17% firmer Tuesday

The N6.301billion turnover Value recorded by the market on Monday was 55.74% lower than the N14.236billion recorded the last trading day of the week ended 12th January 2018, with 730.618 million Units of shares traded in 7,964 deals against 1.394billion units traded in 11,385 deals in the corresponding trading sessions.

Sector Performance

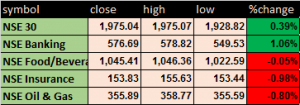

NSE30 index gained 0.39% to close at 1,975.07.

NSE Banking Index Gained 1.06%, following the advancement in major banking stocks like ZENITHBANK which gained 2.37%, GUARANTY which gained 2.24%, FCMB which gained 9.84%, FIDELITY which gained 5.% and FBNH which gained 0.78%.

The decline in NB (-1.30%), DANGSUGAR (-4.56%) and FLOURMILL (-4.31%) drove the NSE Consumer Goods Index to close lower by 0.05%.

NSE Industrial Index Shed 1.56%, largely driven by the 4.99% loss in WAPCO.

NSE Insurance Index down by 0.98% and finally

NSE Oil and Gas Index declined by 0.80%, on the back of the losses in FO (-4.69%) and ETERNA (-6.82%).

Market Breadth

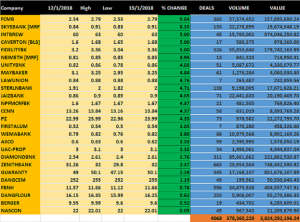

Trading activities for the day produced 26 gainers and 26 losers, bringing the market to a balanced breadth with a positive tints, the aggregate volume recorded by the advancers outweighed that of decliners.

PERCENTAGE GAINERS

FCMB with 9.84% gains topped the percentage gainers’ chart, while ETERNA which lost 6.82% led others with negative price performance.

PERCENTAGE LOSERS

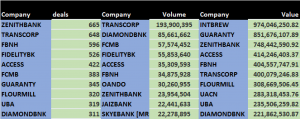

Best Stocks

Transcorp amongst others traded most volume with 193,900,395 units of shares in 648 deals, worth N400.079million.

Year to date the Nigerian market has returned 12.75% as measured by All Share Index. with the current unprecedented oil price rally, market is primed to edge higher.