Wole Olajide

MTN Nigeria, the biggest network as far as telecommunication is concerned in Nigeria increased its market share with addition of 4.2 million subscribers to the network representing a 6.5% increase in Q1’20 to 68.5 million.

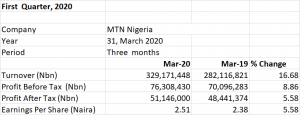

The telecom giant declared a turnover of N329 billion in its first quarter report for 2020. This represents a growth of 16.68 percent when compared to the turnover of N282 billion reported in the first quarter of 2019.

The profit before tax of the telecom giant appreciated by 8.86 percent to N76.308 billion when compared to the pre- tax profit of N70.096 billion reported in the first quarter of 2019.

Profit after tax for the period was N51.146 billion, up by 5.58 percent from N48.441 billion reported in Q1 2019.

The earnings per share MTN Nigeria is N2.51 up by 5.58% when compared to the earnings per share of N2.38 reported in Q1 2019.

Operational Review

Over the quarter MTN increased its market share with addition of 4.2 million subscribers to the network representing a 6.5% increase in the quarter to 68.5 million.

Active data subscribers also increased by 6.6% to 26.8 million, representing an additional 1.7 million data users. The increase in the subscriber base was supported by the development of additional SIM registration devices and various Customer Value Management (CVM) initiatives implemented during the quarter.

Voice revenue growth remained healthy at 7.4% (+3.2% Quarter on Quarter) and accounted for 69.1% of service revenue. Voice traffic increased by 7.2% year on year, supporting revenue growth.

Data revenue, making up 22.6% of service revenue grew by 59.2% (+12.3% quarter on quarter). This was achieved through increased data subscribers and improved 4G penetration which supported traffic growth of 130.4% year on year (25.2% quarter on quarter). 1.6 million new smartphones were added to the network, bringing smartphone penetration to 42.6% of the base.

The digital business returned to growth with revenue increasing by 63.7% (+8.0% quarter on quarter) supported by a rich portfolio of digital products and services and improvement in customer service experience. There was an improvement in the uptake of digital offerings and effort to expand the active user base for the digital business continued to yield positive results. During the quarter, 1.6 million new users were added bringing active base for digital subscriptions to 3.8 million users.

Fintech revenue growth in Q1’20 was driven by an increase in the adoption of MTN Xtratime, an airtime lending service. Seventy thousand (70,000) MoMo agents were added in the quarter, bringing the total number of registered agents to 178,000 nationwide. The total volume of transactions processed by agents during the quarter was over 5.6 million, about 805 of it were airtime vending.

The enterprise business segment improved with growth of 12.7%. Enterprise business includes revenue from mobile and fixed connectivity, cloud and ICT solutions and devices. It cuts across voice, data and digital services for SMEs, public sector and large enterprise customers.

Operating expenses increased by 22.3%, driven mainly by an increase in lease in lease rental costs, following an aggressive 4G roll site rollout. Capital expenditure, excluding right of use assets N24.7 billion.

Overall, MTN Nigeria reported growth of 8.9% in profit before tax (N76.3 billion), which was impacted by an increase in Finance Costs due to higher borrowings.

The profit after tax and earnings per share of the Telco giant both appreciated by 5.58% to settle at N51.146 billion and N2.51 respectively.

Funding and Liquidity

MTN Nigeria is currently diversifying funding strategies and sources to fast track capital expenditure related to hardware investment and to optimize its funding costs.

MTN has strong free cash flow and approved loan facility headroom to meet financial obligatiions. In line with existing banking covenants, there is headroom to leverage the balance sheet optimally for strategic investments.

The telecom firm was able to keep foreign currency exposures within manageable limits so that the balance sheet can withstand currency volatility. The debt split is 92% in local currency and 85 in foreign currency.

CSR during Covid -19 lockdown

The pandemic triggered demand and supply chain disruption, resulting in the slowdown of economic activities. The lockdown order by the Federal Government of Nigeria in response to the COVID-19 pandemic classified telecommunications as essential services.

MTN recognized the immense importance of reliable telecommunications services and took the necessary steps to ensure that its services remain available to our customers, in spite of the disruption.

To support customers and communities in fight against the COVID-19 pandemic, MTN launched the ‘Yello Hope Package’, a broad set of initiatives deployed to support national efforts at combatting the spread of the COVID-19 virus, mitigate the pandemic social impact and keep customers connected to their loved ones.

In addition to MTN’s direct contributions to support the fight against COVID-19, including support to CACOVID (N1 billion), Federal and State Governments (communications support) and the NCDC (Devices, airtime, SMS channel, and data) MTN provided its customers with a range of free services to help make communication easier.

- More than 2 Billion free SMS were sent by over 40 million subscribers.

- About 3,000 Terrabytes of free data were utilized to access zero-rated health websites

- Over 1.7 Million free money transfers by about 100,000 people using the MoMo Agent Network

Tower Providers’ Contract

In 2014, MTN made a strategic decision to sell passive infrastructure to enable the company to focus on its core business. Although MTN Nigeria continues to own a small number of towers, it currently has lease agreements with various tower providers and this constitutes a significant portion of service cost.

Outlook

MTN started the year with an upbeat view of the prospects for the business in 2020, which was substantiated by the strong performance in service revenue delivered in the first quarter. However, recent developments relating to the COVID-19 pandemic, oil price volatility, foreign exchange rates and availability call for a more measured outlook in the near term. The remainder of the year will be shaped by the impact of these developments, which remains highly uncertain at this time.

Voice revenue experienced an immediate impact from the current macro disruptions, based on early trends, especially in the mass market segment. There has been decline in voice traffic largely due to slowdown in economic activity and a reduction in people’s earning capacity. Although there is growth in data revenue, it does not fully offset the decline in voice revenue. This may persist should there be continued macro-economic challenges.

MTN stated that it will continue to invest in the network to provide adequate capacity and resilience. This is key as data traffic on the network continues to increase. Although, the situation remains fluid due to uncertainties around the potential impact of COVID-19 as well as oil price, foreign exchange rates volatility and foreign currency availability on the business.

The firm will continually assess the situation and implement adequate interventions accordingly. MTN believes that the business is well placed to weather the current macro-economic and social disruptions.