The positive vibration in the market today (Wednesday November 25, 2020), confirms the recovery of yesterday that it is not joking with information at the market place.

The Monetary Policy Committee of CBN retained all the rates yesterday. Donald Trump has agreed that Biden should start transition program. Oil price has gotten to $45 per barrel and from all indication it is still looking forward.

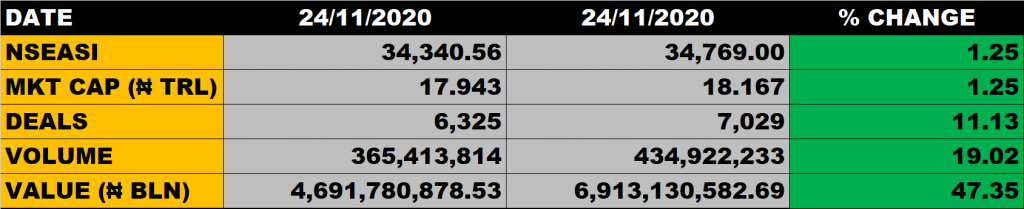

The equity market closed on a positive note as the All Share Index appreciated by 1.25% to settle at 34,769.00 points from the previous close of 34,340.56 points. The market capitalisation grew to N18.167 trillion from the previous close of N17.943 trillion which translates to N224 billion gain.

The market breadth closed positive as 37 equities gained while 11 equities declined in their share prices.

An aggregate of 434.92 million units of shares were traded in 7,029 deals, valued at N6.91 billion.

Stocks to Watch

Investors should continue to take position in fundamentally sound stocks.

The share prices of Access, UBA and First Bank, Zenith, FCMB and Fidelity have pull back, it’s only that Guaranty Trust Bank has rigidity that it can stabilize at a particular price.

In terms of dividend yield, investors should look at Zenith, Access, First Bank and UBA; they will be better for it.

WAPCO should also be on investors’ watch list because they are doing well.

Percentage Gainers

May & Baker led other gainers with 10% growth to close at N3.52 from the previous close of N3.2.

UDPC Real Estate Investment Trust, Eterna Plc, Flour Mills, AXA Mansard, Transcorp and FCMB among other gainer also grew their share prices by 9.89%, 9.88%, 9.84%, 9.83%, 9.78% and 9.63% respectively.

Percentage Losers

Trans Nationwide Express led other price decliners as it shed 9.38% of its share price to close at N0.87 from the previous close of N0.96.

ABC Transport and Cornerstone Insurance among other price decliners also shed their share prices by 8.57% and 7.94% respectively.

Volume Drivers

- Transcorp traded about 84.5 million units of its shares in 236 deals, valued at N84.27 million.

- Zenith Bank traded about 59.22 million units of its shares in 738 deals, valued at N1.48 billion.

- Access Bank traded about 29.89 million units of its shares in 371 deals, valued at N258.45 billion.