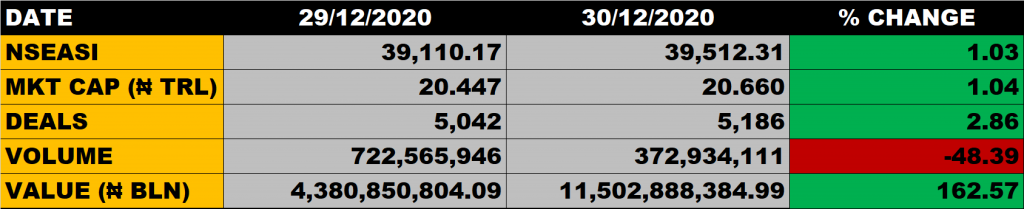

The Nigerian equity market on Wednesday closed on a positive note as the All Share Index appreciated by 1.03% to settle at 39,512.31 points from the previous close of 39,110.17 points. Investors gained N213 billion as Market Capitalisation increased by 1.04% to N20.660 trillion from the previous close of N20.447 trillion.

An aggregate of 372.93 million units of shares were traded in 5,186 deals, valued at N11.5 billion.

The market breadth closed positive as 24 stocks appreciated in their share prices against 19 stocks that declined in their share prices.

Stocks to Watch

Investors should continue to pitch their tent with fundamentally sound stocks. As full year result of quoted companies is around the corner, investors should take advantage of stocks with good dividend yield.

- Access Bank dropped N8.75 from to N8.95. It is currently trading 27.08% away from its 52 weeks high of N12. At that, there is uptrend potential in the share price of Access Bank.

- FBN Holdings grew to N7.2 from N7.10. It is trading 20% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant.

- Zenith Bank dropped to N24.95 from N25. It is trading 12.46% away from its 52 weeks high of N28.5.

- WAPCO traded flat at N21. It is trading 19.23% away from its 52 weeks high of N26, which implies an uptrend potential for the share price of the company.

- UBA grew to N8.55 from N8.50. It is trading 12.76% away from its 52 weeks high of N9.8. There is growth potential in the share price of the bank.

- Guaranty Trust Bank dropped to N32.5 from N32.7. It is trading 15.47% away from its 52 weeks high of N38.45, which suggest an uptrend potential for the share price of Guaranty Trust Bank.

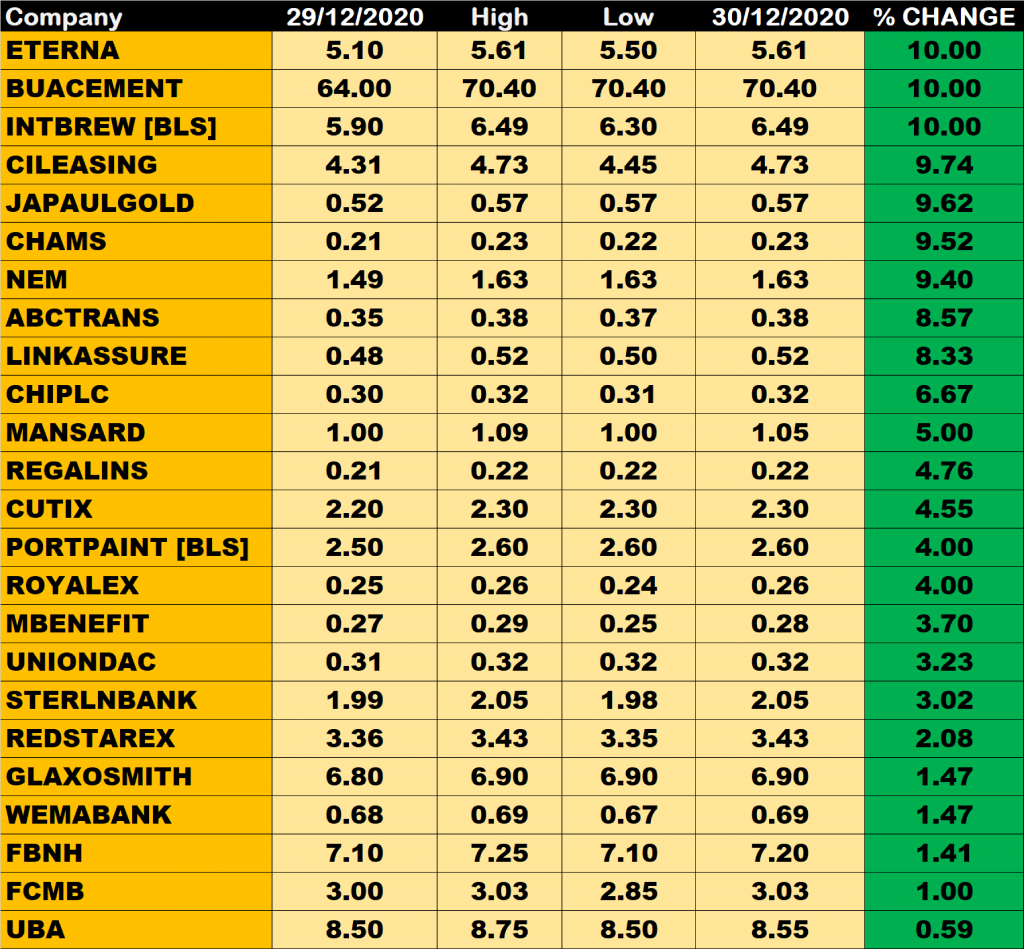

Percentage Gainers

BUA Cement, Eterna Plc and international Breweries all gained 10% to close at N70.40, N5.61 and N6.41 respectively.

C&I Leasing, Japaul Gold, Chams Plc and NEM Insurance among other gainers also grew their share prices by 9.74%, 9.62%, 9.52% and 9.40% respectively.

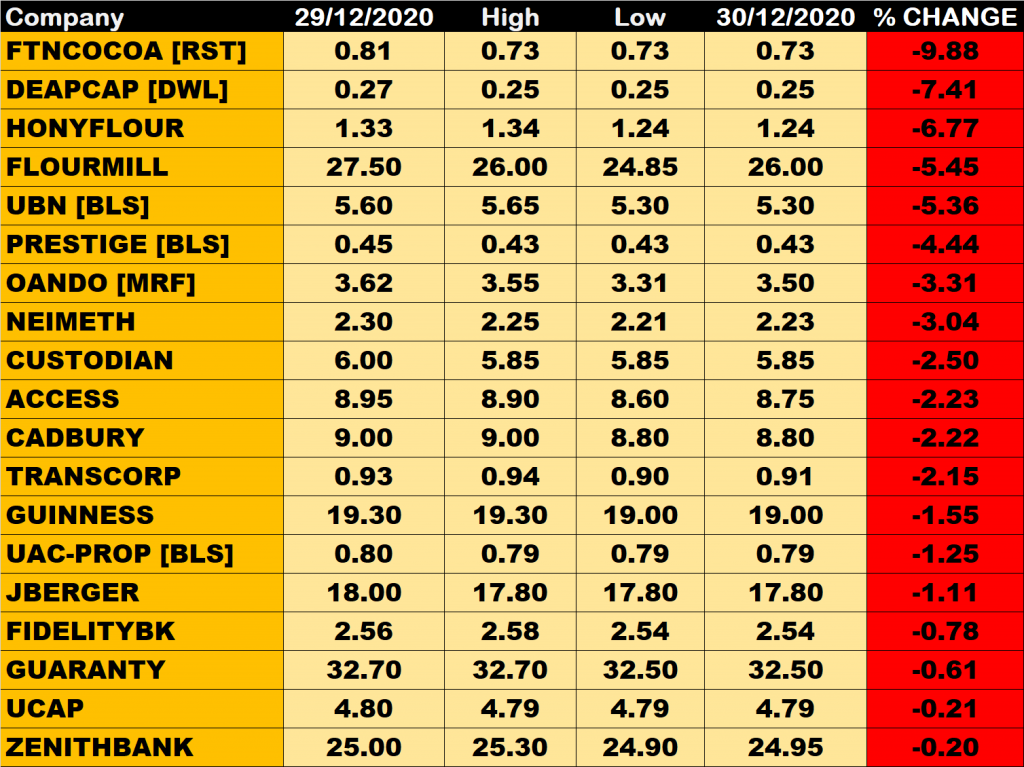

Percentage Losers

FTN Cocoa led other price decliners as it shed 9.88% of its share price to close at N0.73 from the previous close of N0.81.

Deap Capital Management & Trust Plc and Honeywell Flour among other price decliners also shed their share prices by 7.41% and 6.77% respectively.

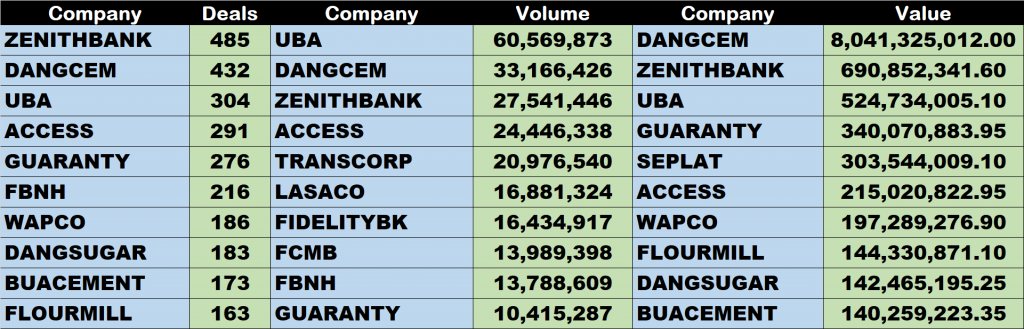

Volume Drivers

- UBA traded about 60.57 million units of its shares in 304 deals, valued at N524.73 million.

- Dangote Cement traded about 33.17 million units of its shares in 432 deals, valued at N8.04 billion.

- Zenith Bank traded about 27.54 million units of its shares in 485 deals, valued at N690.85 million.