MARKET SUMMARY: JANUARY – JUNE 2020:

It has been a turbulent year so far for the world economy at large. In all, doors of the floors of the Nigerian Stock Exchange are still wide open and the first half of 2020 is over. The market had been good and bad, turbulent and stable. Money had been made and lost within this period. The Nigerian market might not have emerged best in Africa in the first half of 2020, it’s however not the worse but one of the most vibrant and rewarding market with lots of possibilities ahead.

Considering the fact that the market is naturally expected to respond the global epidemic which struck the world in the beginning of the year 2020, the sustaining ability recorded so far is great, thus current market status is highly commendable. Technically speaking, the market is resilient.at every point the bear seems to be having upper hands, the market does not give in easily. These are unique features of a properly structured market with inbuilt drive for not just survival but excellence. In other words, though no market could be said to be immune to total crash in the world, the Nigerian Bourse is in the class of global high profile markets with shock absorbers against storms that often collapse stock markets.

THE JOURNEY SO FAR:

Q1 2020

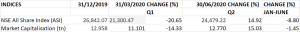

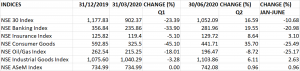

- Q1 2020 performance can be adjudge poor. The period saw all indexes recording varied percentages of losses except ASEM which closed flat. In other words, the period between January and March was turbulent for the market generally.

- In Q1, NSE Consumer Goods Index was the worst hit after it declined terrifically by 45.10%, with NSE Banking Index coming behind with a loss of 33.90%. These are clear indicators of already distressed economy revealing a declined household spending on even essential goods.

- The Q1 performance also revealed the status of foreign institutional investors as being bearish early in the year as there was a reported deficit in foreign portfolio investment to a margin of about 356%.

The market all share index declined by 20.65% within this period under review.

Q2 2020

- Q2 2020 was lot better as all indicators except NSE Oil/Gas were up.

- In Q2, NSE Consumer goods was outstandingly the best recording a 35.70% growth within the period under review with NSE Banking coming behind with 19.55 quarterly growth.

- The All Share Index for this period grew 14.92%

Generally, the market return in the first half of the year 2020 stood at negative 8.80%.

BEST STOCKS IN H1 2020

In the half year of 2020, thirty one equities appeared on the gainers list while seventy nine featured on the losers’ chart.

The first quarter of 2020 brought unprecedented levels of market volatility and significant negative absolute returns across most equity markets as the coronavirus pandemic swept around the globe. The uncertainty around the dwindling global oil price also called for the poor performance.

In Q2, the market defy all prediction of possible market downturn growing significantly, almost wiping off the entire loss already recorded in the year.

NEIMETH

Growing its price of N0.62 at close of trading session in 2019 to N1.65 at the close of trading on June 30, 2020, Neimeth led all other stocks on the floor of the Nigerian Stock Exchange in the period under review with a growth of 166.13%.

When covid19 hit, the market believed that pharmaceutical companies will be the better for it. Neimeth was seriously under-priced. As at January 2, 2020, Neimeth was 62 kobo, while the likes of My & Baker, Fidson and Glaxo were about N5, N4 plus. The market knows that Neimeth belongs to that peer group; so the market needs to price it to go and meet its peer group, and that’s why the price rose from 62 kobo to N2.82 kobo; though the machine registered N2.57 (creating a strong resistance) on June 11, 2020 before it eventually dropped to N1.14 (a strong support) and finally closed at N1.65 to end the month of June. It closed N1.50 last Friday, raging for a significant direction.

.MAY & BAKER

Also in the same pharmaceutical league as Neimeth, May & Baker also achieved an unprecedented price rally in the review month. It price moved from N1.93 it traded last on 31st December 2019 to N2.87, translating to a 106% growth in the period under review.

If any incentive is coming to the pharmaceuticals, it will come from the World Health Organisation (W.H.O). May & Baker has facilities that is W.H.O certified. The government wanted to partner with May & Baker at a time and it push the price up. If they want to manufacture vaccine for covid-19, they will be the first to consider; though it will also get to other pharmaceutical firms. The chairman of May & Baker, Danjuma is close to the government. It is believed that to get business out of government, May & Baker will be the first on the list.

OKOMU OIL

Okomu Oil is in the Agricultural sector and it has being doing well. Okomu in their life time has paid N7 dividend in this market before and one for one bonus. This present government favours agriculture. The markt belives that favourable agriculture policy would have impacted on the Oil palm company and because Okumu is doing better than Presco, that’s why the market is looking at Okomu’s side rather than that of Presco. The stock price grew 39.21% in the review period from N55.6 it closed last year, to N77.4 it closed on the last trading day of June 2020. It’s currently trading at its one year peak and may not be suitable for immediate entry but a slight pullback should afford a decent entry.

MOBIL (11 PLC)

There was this news that 11 Plc is preparing to delist from NSE, though not yet confirmed (more less a rumour). From history any company that is delisting will delist at a premium, higher than the market price to favour the current shareholders. Probably people were taking position in lieu of that delisting.

The stock grew 30.22% in the review period from N147.9 to N192.6.it traded as high as N213.90 per share and as low as N133.20 per share within the review period. This shows the stock is highly volatile and should be traded with caution.

AIICO INSURANCE

AIICO began the year with a share price of N0.72 NGN and gained 27.78% on that price valuation, ranking it 7th on the NSE in terms of half year performance, closing at N0.92 at the end of June 2020.

There is this recent news that a bank wants to buy over AIICO pension. Whenever there is acquisition like that, the market always believe that the acquirer after due diligence has seen value in that business. So the market will position itself before the consummation of the acquisition so that they will benefit.

Investors should, however, take caution of AIICO’s recent poor performance, having lost 21.1% of its value in the past four weeks. The AIICO stock closed its last trading day (Friday, July 3, 2020) at 0.86 NGN per share on the Nigerian Stock Exchange, recording a 3.37% drop from its previous closing price of 0.89 NGN.

VITAFOAM

Vitafoam year end is June. What they paid last year is considered by the market as good dividend. So investors are positioning ahead of the release of their 4th quarter result.

VITAFOAM began the year with a share price of N4.40 NGN and grew 27.05% to N5.59 as at the end of half year 2020, ranking it 8th on the NSE in terms of half year performance.

JAPAUL OIL

The only thing that would have happened to Japaul was because of the idiosyncrasy of the market. That is, when they announced that they are going to do their rights or they are going to involve in capital market activities, whether by rights, public offer, bond or any other method to raise money. Japaul is changing their line of business to go into mining which they were from the beginning. It’s like they are leaving Oil Exploration to Gold mining. For the fact that the stock is cheap, moving it from 20 kobo to 27 kobo does not really cost anything. So there is really not anything moving Japaul.

MTN NIGERIA

MTN is a strong stock as far as the market is concerned. They paid good interim dividend. MTN is not supposed to be impacted by covid-19 because while down, it is data they were using to access zoom for conferences. Calls was on data. The fact that we were not going out, we were depending on network to do all our businesses. You want to transfer money, if you don’t have data on your phone, you cannot do the transfer. You cannot access any application without data. Staying at home increased that subscription seriously. Before covid-19, people used to go to the bank to go and pay for their Pay TV and for other transactions; but during lockdown everything was done online and that seriously favours the network providers. The market is not really looking at Airtel the way they are looking at MTN. MTN is supposed to be the number one mobile network in the country whether we like it or not.

AIRTEL

The factor that favoured the price of MTN is what rubbed off on Airtel. During lockdown, it is believed that people depended seriously on network providers for Data subscription and airtime.

FCMB

That FCMB was among gainers could be because it was resilient. There is no special thing holding FCMB. If there is any stock that is supposed to have been among gainers, it would have been Zenith Bank. So FCMB’s emergence on the gainers list for the half year is just market interplay; that is forces of demand and supply.

AFRIPRUD

Afripud and UCAP both belong to the same family. They are the first to release result to the market. It used to be Forte Oil and Nigerian Breweries. There is an adage that when a kid have a good result, he is eager to show his report card. Afriprud has always paid good dividend. Their dividend yield is always superlative as far as the capital market is concerned, 10% and above. It gives people focussed on the stock.

LAW UNION & ROCKS INSURANCE

Law Union & Rocks Insurance grew its share price by 106% from 50 kobo to N1.03. The share price of the underwriting firm in the past 52 weeks has touched a high of N1.22 and a low of 33 kobo. The underwriting firm in the first quarter of 2020, achieved the Gross Premium Written of N2.099 billion and profit after tax of N31.95 million.

EKOCORPS PLC

The share price of the Ekocorps Plc appreciated by 41.18%, closing the half year at N6 from N4.25 on December 31, 2020. In the last 52 weeks, share price of Ekocorps reached a high of N6.00 and a low of N3.40. The firm in its Q1 financial report declared a loss of N75.89 million, though the turnover achieved was N273.6 million.

Sustainability of the prices of the stocks that rallied in the half year of 2020 depends on the outcome of second quarter result. Any stock that performed up to expectation due in their Q2 result, the market will reward it; and at that time, increase in price is obtainable. But if their result is not fantastic, the market will reprice them one by one.

As we have said umpteen time, based on the above position, investors should take caution owing to the fact that the expected q2 reports are projected not to be too fantastic but we all know the market having the mind of its own would of inevitability chart its own course.