Manufacturing has generally been described and accepted as an engine of growth and development of any country. In modern economies, industrialization under industrial sector is widely conceived as critical tool for accelerating economic growth and development. In as much as individuals have taken the bull by the horns to dabble, investors had got lower than encouraging cash dividend payout over the years.

To a large extent, manufacturing companies in Nigeria have over the years scaled through several hurdles and obvious challenges to remain in business, top of these is financing while others include infrastructure, low purchasing power and Government policies.

A quick glimpse into books of a few quoted manufacturing companies revealed that most manufacturing companies in Nigeria survive majorly on credit facilities. Unfortunately, high cost of financing had largely impacted negatively on profitability.

A few manufacturing company below were used as case study:

FIDSON HEALTHCARE PLC

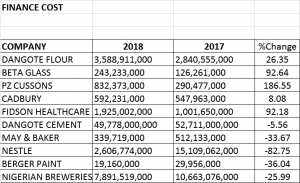

In the audited report of Fidson Healthcare Plc for year ended December 31, 2018, Finance cost was N1.9 billion, up by 92.18% from finance cost of N1billion in 2017. This obviously affected the Profit before Tax of the company as it declined by 89.81% to N160.867 million against PBT of N1.578 billion in 2017.

It is an established fact that manufacturing companies thrive on loans and borrowings to augment their working capital. The cost, interest, and other charges involved in the borrowing of money to build or purchase assets by these companies is the Finance Cost.

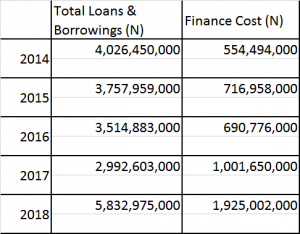

Trend in Loan exposure and cost of finance

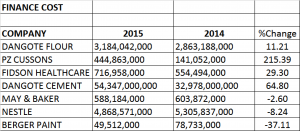

- In 2014, finance cost of N554.49 million was used to service an aggregate loan of N4.026 billion.

- In 2015 finance cost rose by 29.3%, at N716.96million. As at then total loans & borrowings was N3.76 billion.

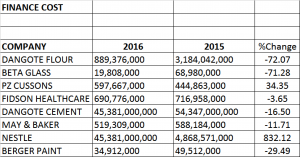

- Finance cost in 2016 reduced by 3.65% from N716.96million of 2015 to N690.78 million in servicing the loan of N3.5 billion.

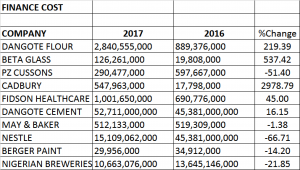

- In 2017, the firm borrowed N2.99 billion; Finance cost was N1 billion, up by 45% from the previous year.

- In 2018, loan exposure of Fidson increased to N5.83 billion compared to the previous year’s loan of N2.99 billion. Finance cost was N1.9 billion up by 92.18% from the previous finance cost of N1 billion in 2017.

Dangote Cement

Dangote Cement in its audited financial report for Full Year 2018 posted a Profit before Tax (PBT) of N300.81 billion, which is 3.87% growth from the PBT of N289.59 billion in 2017. Finance cost for 2018 was down by 5.56% giving the PBT a boost when compared to the PBT in 2017 when the finance cost was up by 16.15%.

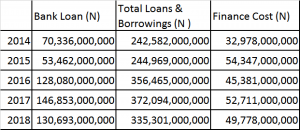

Trend in Loan exposure and cost of finance

Aggregate value of loans and borrowings for Dangote Cement from 2014 till date is stated below:

- In 2015 cost of finance rose by 64.8%, while in 2016, it declined by 16.50%. Finance cost in 2017 rose by 16.15%, it however came down by 5.56% in 2018.

- About 40.83% of the total borrowings in 2014 came from the bank. In 2015, 27.91% of total borrowings came from the bank.In 2016, about 56.08% of total loan came from the bank. While in 2017 and 2018 portion of bank loans from the total loan are 65.2% and 63.87% respectively.

Nestle Nigeria

Nestlé Nigeria PLC is one of the largest food and beverage companies in Africa. For over 57 years, Nestlé has been delighting consumers in Nigeria with high quality nutritious food products.

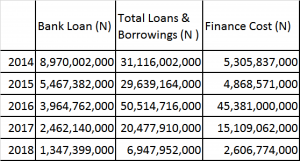

Trend in loan exposure and cost of finance

The cost of servicing debts for Nestle Nigeria as shown in the table above reveals how Finance cost affects the profitability of manufacturing companies in Nigeria.

The Profit before Tax of Nestle Nigeria in its Audited report for the year ended December 31, 2018 was 59.75 bn, up by 29.59% from the previous PBT of 46.83bn. This can be attributed to the finance cost that reduced appreciably by 82.75% compared the previous cost of Finance of N15.1bn in 2017.

PZ Cussions Nigeria

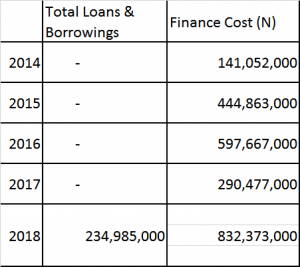

PZ Cussons Nigeria Plc posted a declined PBT of 51.91% in its audited Financial Statements for the year ended May 31st, 2018 after about 186% rise in its COF which closed the year at N832mn from 2017’s N290mn. This suggests why Net Profit as well as EPS for the period plunged by 47.73% in its audited financial report released to the market on August 31st, 2018.

- In 2014 and 2015, Finance Cost of N141.052mn and N444.863mn were used to service previous years accumulated Loans & Borrowings as the company recorded no Loans and borrowings for both years of 2014 and 2015 audited reports.

- In 2017, Finance Cost of PZ dropped by 51.40% to about N290mn from about N597mn recorded in 2016 while the company still maintained 0% Loans & Borrowings for both periods. As a results the company’s PBT and PAT soared by 52.8% and 73.1% respectively.